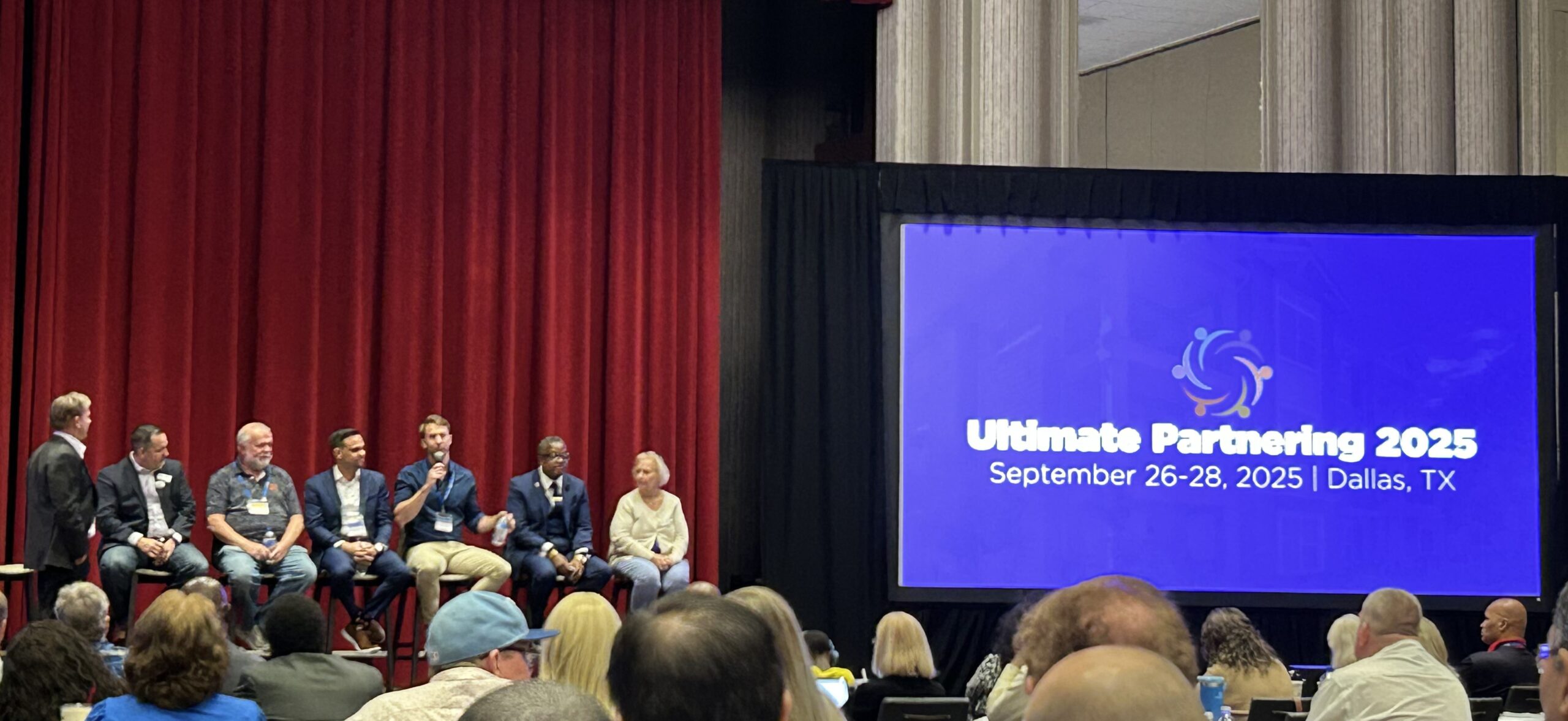

I had the pleasure of being on the “How to get started in Real Estate”…

21 George Newsletter January 2024

“I can’t control how many reps I get in practice, but I can control what I do with them”

– The 2000 New England Patriots 4th string QB

Better late than never! Check out this video of a property we went full cycle on in 2022.

I hesitate to share this because of the outsized return we achieved on this project, but a lot of hard work went into this project, and well, it’s a cool video!

We acquired this 52-unit property in March 2020, implemented our renovation strategy over a 2+ year span, and sold it in June 2022 achieving an amazing deal level 85% Annualized Return!

We typically target 18%+ average annual returns to our investors.

Real estate is a conservative investment that has tax benefits, and when managed correctly, provides cash flow, capital preservation, and long-term appreciation. We would never pitch a deal with 85% annualized returns. We look for deals that will provide 18%+ annual returns to investors. For this deal, we projected about a 20% annualized return to investors. Here are the two main reasons we achieved outsized returns on this project:

- We had an extremely attentive and experienced asset management team that was committed to the project. Heavy value-add Class C properties can provide larger upside potential, but there is more risk inherent in these deals as well. The more that needs to be done to a property, the more there is that can go wrong. And things will go wrong. An extremely present and experienced asset management team is needed to successfully execute heavy value-add deals. Here are some of the obstacles we overcame:

- Unfortunately, we did not get any “before” pictures in this video because this property was a heavy lift. We redid all of the concrete in the courtyard and the landscaping to improvement the properties curb appeal, replaced a portion of the roof, addressed significant deferred maintenance including tuckpointing and repairing the walkways, and renovated units.

- We acquired the property at 75% occupancy and high delinquency rate among inherited tenants. We had to improve operations to increase occupancy and collections. This was not easy with Covid affecting landlord tenant laws.

- This video also doesn’t show the significant hurdles we faced obtaining debt financing to acquire this property. We acquired this property in March of 2020 just as Covid was hitting and the economy was shutting down. The property was 75% occupied which creates additional problems with lenders. We had lenders walk away from the deal on us, but we saw the potential in the deal so we stuck with it and it paid off.

- Between 2020 and 2022 property values all across the country skyrocketed. This of course contributed to the outsized returns. We wish we could tell you that we have a secret recipe allowing us to time the market perfectly, but we do not. And no one does. (I don’t remember people predicting values skyrocketing over the next two years when the economy was shutting down in April 2020…) Instead, we focused on effectively implementing our asset plan to get the property in great condition so it would demand top of the market value when it came time to sell.

We can’t control number 2, but we can control number 1. While it is important to continuously monitor economic and housing data, we do not pretend to have a crystal ball that tells us how multifamily housing will perform in the future. Interest rate movement is constantly in the news and everyone seems to have in opinion on it, but it is really a waste of time trying to predict where rates will be 6+ months and how those rates will affect your investments. Instead, we focus on our ability to identify undervalued multifamily investment opportunities, and put systems and teams in place to effectively implement value-add strategies and manage them.

At some points in the market cycle there will be more opportunity than others. But at ALL points in the market cycle you need a great asset management team to effectively implement asset plans.