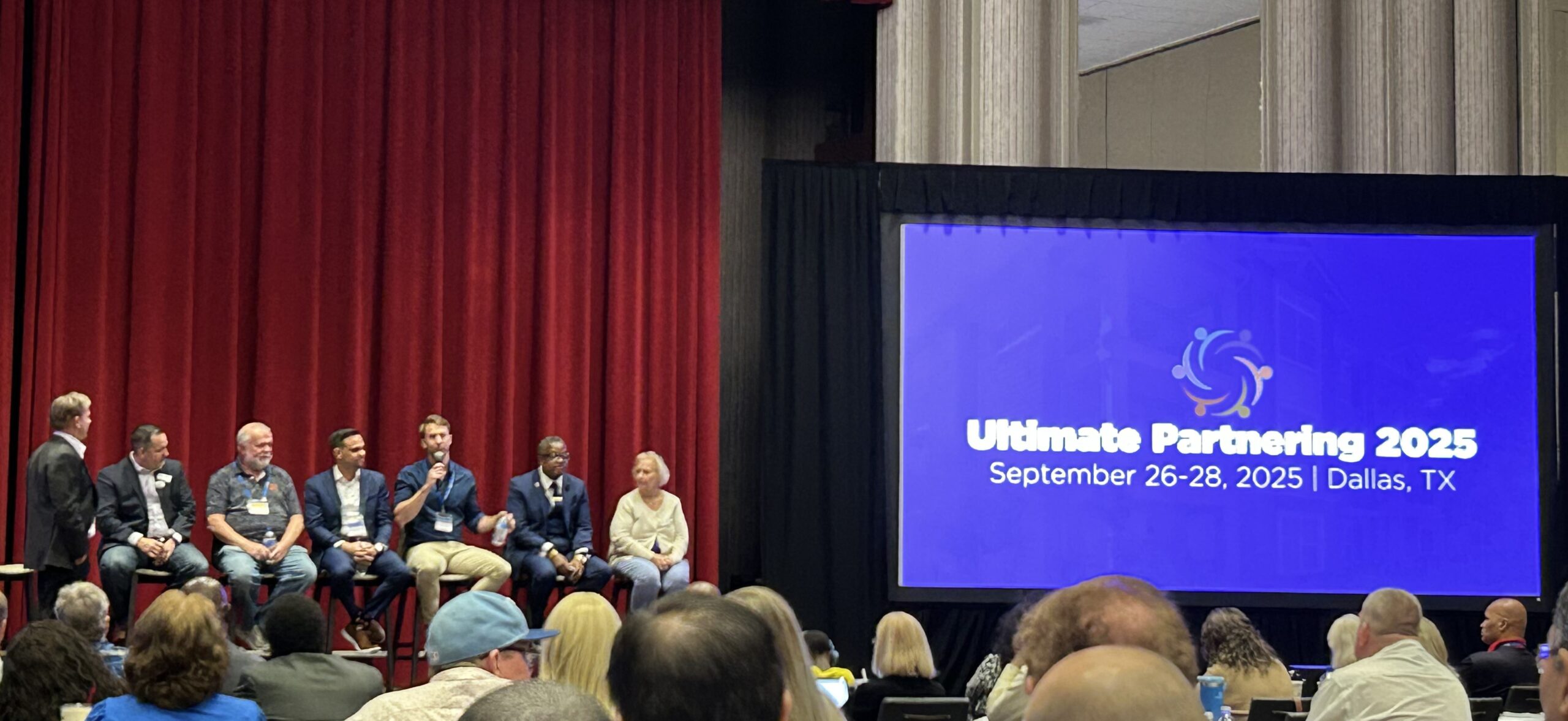

I had the pleasure of being on the “How to get started in Real Estate”…

21 George Newsletter November 2022

A few weeks ago, we attended RE Mentors Ultimate Partnering event in Phoenix, AZ. This is a can’t miss event for us every year as it is full of great speakers sharing market perspectives, continued education, and success stories! It is also an opportunity to network with nearly 1,000 industry professionals and learn more about the different investment strategies investors are deploying in the current market environment. These events are a great way to stay in tune with what’s going on in the market, so with rising interest rates and the first real inflationary period in decades, the timing of this event could not have been better.

The event was very educational and informative, but we also had a great time! It is great to connect with people we have known for years but don’t get to see too often, and meet many great new people as well. I even got to speak on one of the panels this year!

Acquisitions/Dispositions

Unfortunately, we do not have any new deals under contract to report on, but we continue to actively seek new opportunities in New Hampshire, Baltimore, and certain Southeast and Midwest markets.

With rising interest rates, we are slowing seeing price expectations come down. Investors who over-leveraged their assets with floating interest rates over the last couple of years may become more motivated to sell if their value-add is not going as planned and their monthly debt payments increase due to the rising interest rates. This could create more of a buying opportunity, but we have not quite seen this yet.

The majority of the opportunities we continue to evaluate are:

- Class-A or Class-B assets with lower but more stable returns. These assets typically have higher income earning tenants, perform better during a recession, and appreciate well over time.

- Value-Add’s that do not cash flow for the first 9-18 months. Years ago, it was more common to identify and acquire value-add deals that would still cash flow 7%+ the first year. As Cap Rates compressed nationally over the past couple of years, we are finding that at least a portion of the value-add has to be implemented before these opportunities will start to cash flow. They are still good opportunities, but require a little more patience.

- Mezzanine Debt- as interest rates increase, lenders are lowering their loan proceeds. Investors looking to refinance may not be getting the proceeds needed from their primary lender to successfully refinance out of their existing loan. This could be an opportunity for private investors to offer mezzanine debt at a higher interest rate. This is a strategy we are exploring.

Asset Management

Over the past quarter we have also made some improvements to our existing assets. We installed a new wood pellet heating system in one of our assets to reduce carbon emissions and cut our fuel expense in half. We made another asset completely lead-safe, and installed all new windows and siding.

The ability to make physical improvements directly to a hard asset continues to be on of the best hedges against inflation.

About 21 George

21 George Investors is a privately held investment firm focused on income producing multi-family real estate opportunities with value add components in specific US emerging markets. By leveraging industry expertise we have implemented a proven proprietary system focused on market knowledge, asset analysis, and asset management allowing us to provide high yield passive cash flow and long-term capital appreciation investment opportunities.