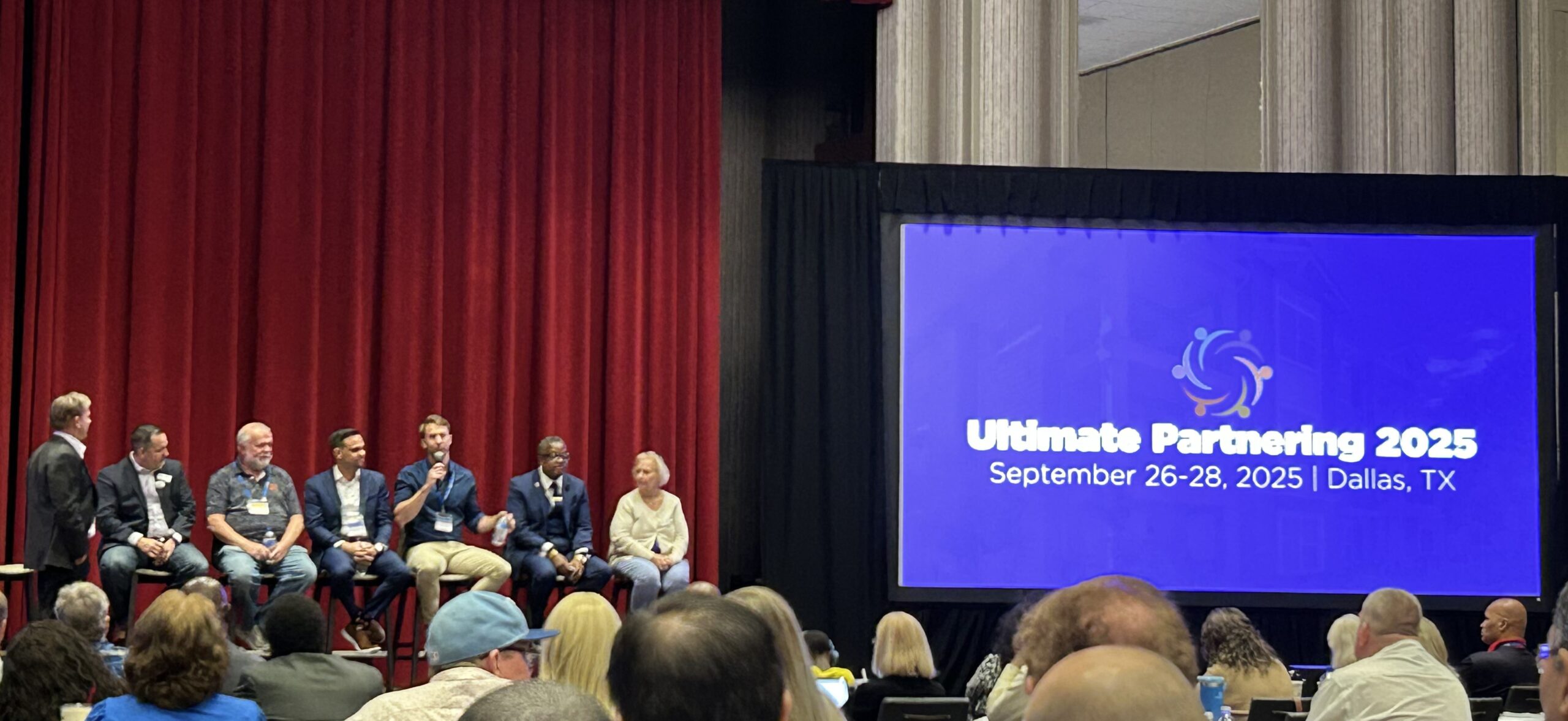

I had the pleasure of being on the “How to get started in Real Estate”…

21 George- What do decreasing interest rates mean for real estate investors?

When the Fed decreased the interest rate for the first time in three years about a month ago, the news was everywhere. I received an abundance of emails, and posts were all over social media notifying me of the announcement.

But what does decreasing interest rates really mean if you are a real estate investor? Well, it depends on what angle you are looking at it from…

Generally speaking and in a vacuum, with lower rates, asset values should increase over time; the ability to borrow money at a cheaper rate allows people to pay more for assets.

Multifamily owners with existing variable rate loans

This is the segment of multifamily owners that have received the most attention over the last year or so. A variable rate loan is a loan with an interest rate that is not “fixed” upon inception. So, if interest rates go up or down, the borrower’s rate will fluctuate accordingly over the duration of the loan. The common headline about operators in this situation is: they did not budget for the unprecedented increase in rates over the past couple years, and therefore, will default on their loans, or at the very least, not meet their return projections to investors because of the higher interest expense. As with most headlines, this rings true for some investors with variable rate loans, but not all.

Decreasing interest rates benefit operators with variable rate loans because it decreases their interest payments, or potentially allows them to find a buyer to acquire their asset at a slightly higher price. But for operators who are already in default or underwater on their loans, it could be too little too late.

Multifamily owners with long-term, fixed-rate debt

Multifamily owners with long-term, fixed-rate debt, are generally in a good position. If interest rates continue to decrease, multifamily real estate values should increase over time. Having fixed-rate debt allows owners to know what their monthly mortgage payment is going to be over the next 3-, 5-, 10-years, and helps owners avoid being the “motivated seller”, which often results in selling at a discount. The ability to have flexibility as to when you sell is a huge advantage.

The one thing to keep an eye on, is that lower interest rates does typically spur new housing development. New housing supply creates more housing competition and can flatten rent growth, resulting in lower multifamily values. Since there is a large housing shortage nation wide, this is not necessarily a near-term concern, but Supply and Demand dynamics is always something to keep an eye on in your local market.

Multifamily Acquisitions

The general sentiment is that when interest rates are lower, it becomes a good time to buy. But that is not necessarily true.

Every real estate cycle is different, but we have seen in the past that when rates go down, lenders typically become more willing to lend. This is partially because with lower rates, it is easier for borrowers to meet the lenders Debt Coverage Ratio requirement. But there is typically a more aggressive sentiment among lenders as well. In a more aggressive lending environment, it may be an “easier” time to acquire multifamily real estate, but that does not necessarily mean it is a “good” time to acquire multifamily real estate. Again, over time, when interest rates go down, values go up. So, if you are borrowing money at a lower rate, but paying a higher price for the asset, isn’t it really net neutral? In 2021 and 2022 rates were near zero and lenders were extremely aggressive, was that the right time to buy multifamily real estate? In hindsight, we now know that time period was the peak of the last cycle.

Decreasing interest rates is typically a signal of a softening economy as well. If that is the case, I think most would agree that it is not the right time to buy as the economy softens. I am not making any predictions as to where the economy is heading, rather simply trying to debunk the sentiment that just because interest rates go down, it immediately becomes a good time to buy. There is a lot more that goes into it.

While it is important to monitor interest rates, there are much more important things to pay attention to as a real estate operator or investor that get far less attention.

As an operator, spend time building out your acquisition pipeline and systems so you can find good deals at any point in the cycle. Spend time building out your asset management team and systems so you can execute your asset management plan more efficiently. Spend time building out your investor relations systems so you can effectively communicate with your investors. As a passive investor, look for these operators that have built up good systems, a good team, and a good track record. The team you invest in is far more important than the environment you invest is.