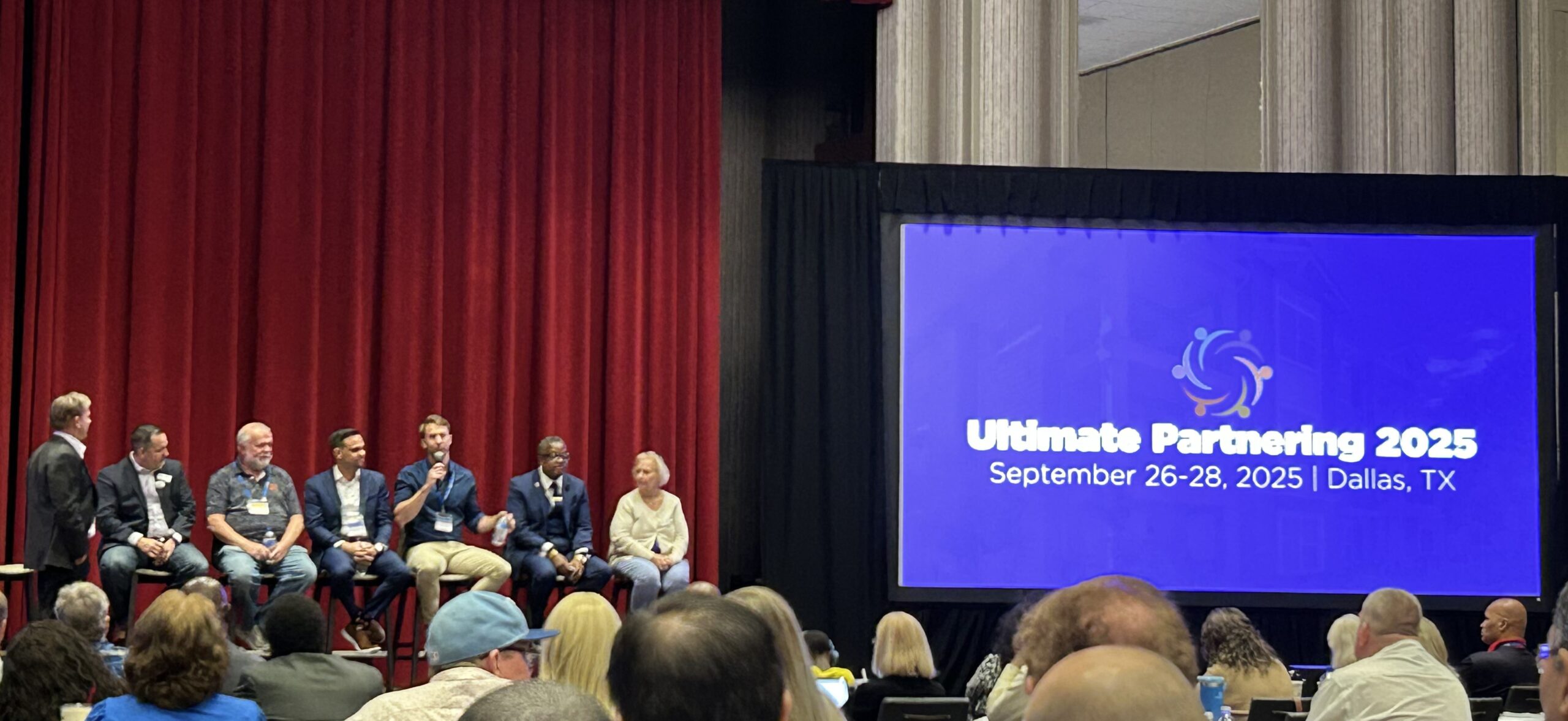

I had the pleasure of being on the “How to get started in Real Estate”…

21 George Newsletter January 2025

Pictured: My Grandfather and Uncle hanging a holiday wreath on the 21 George St. Lowell, MA office building in the early ’90’s.

In 1965, my grandfather and his brothers developed an office building at 21 George St in Lowell, Massachusetts. We chose to use this address as our company name when we started our real estate investment company about a decade ago: 21 George Real Estate Investment Company. For those of you who know Lowell, MA, know it is a courageous endeavor starting any type of business in the Downtown, never mind developing a 20,000sqft office building in the economically volatile, blue-collar city about 45 minutes north of Boston, MA.

However, my grandfather and his siblings grew up in the city and ran a successful law firm there. They were committed to the city they called home and wanted to contribute to the community. While their law firm was successful, the office building was not quite the “cash cow” they anticipated. Outside of their law firm that occupied space in the building, it proved a struggle to lease up the remaining square footage in the non-existent office market. While the building did not perform as expected, the property was always maintained as my grandfather always remained committed to the community.

After the building was sold in 2014, the proceeds from the sale of the struggling office building were used to pivot into multifamily real estate and found 21 George Investors.

The New Year is when everyone begins to make their predictions of what’s to come:

- what interest rates will do

- what the next hot markets will be

- rent growth predictions

- cap rate predictions

- How will the election affect the market?

While it is important to monitor market trends, there is a lot more that goes into a executing a successful real estate investment. Yes, getting into the right market at the right time can enhance success or mitigate failure, but these trends just point us in the right direction. In reality, anything could happen: a global pandemic could hit, interest rates could increase at the fastest rate in history, interest rates could “stay higher for longer”, rent growth could soften, insurance premiums could sky rocket; none of which showed up in the trends before they happened. And what do you do then? None of this showed up on your underwriting template…

Monitor trends, but focus on partnering with the right people and putting the right team in place that will stay committed to the execution of your business plan and the communities you invest in for the unforeseeable future. It is the people that you work with that will contribute the most to your success.

Investing in a property because, “I like the market”, is not a good investment strategy. Instead, get ingrained in the community. Get to know all the players in the market. Put your team of property managers and contractors in place, and then stay committed to the success of your projects. Even in extremely successful deals, things will go wrong and you will need to right people in place to handle the problem. Over the long term, being committed to the communities you invest in and putting a dedicated team in place to execute your business plan will determine your success.

While the story of the office building located at 21 George St in Lowell, MA is not that of a real estate success story, it is a reminder that our real estate investments go beyond our underwriting spreadsheet and demographic trends. We work with brokers, management companies, municipalities, and contractors, we invest in physical buildings that belong to communities and people call home. By staying committed to the people we work with, and the communities we invest in, success will follow. We monitor trends, but focus on the people and properties we invest in.