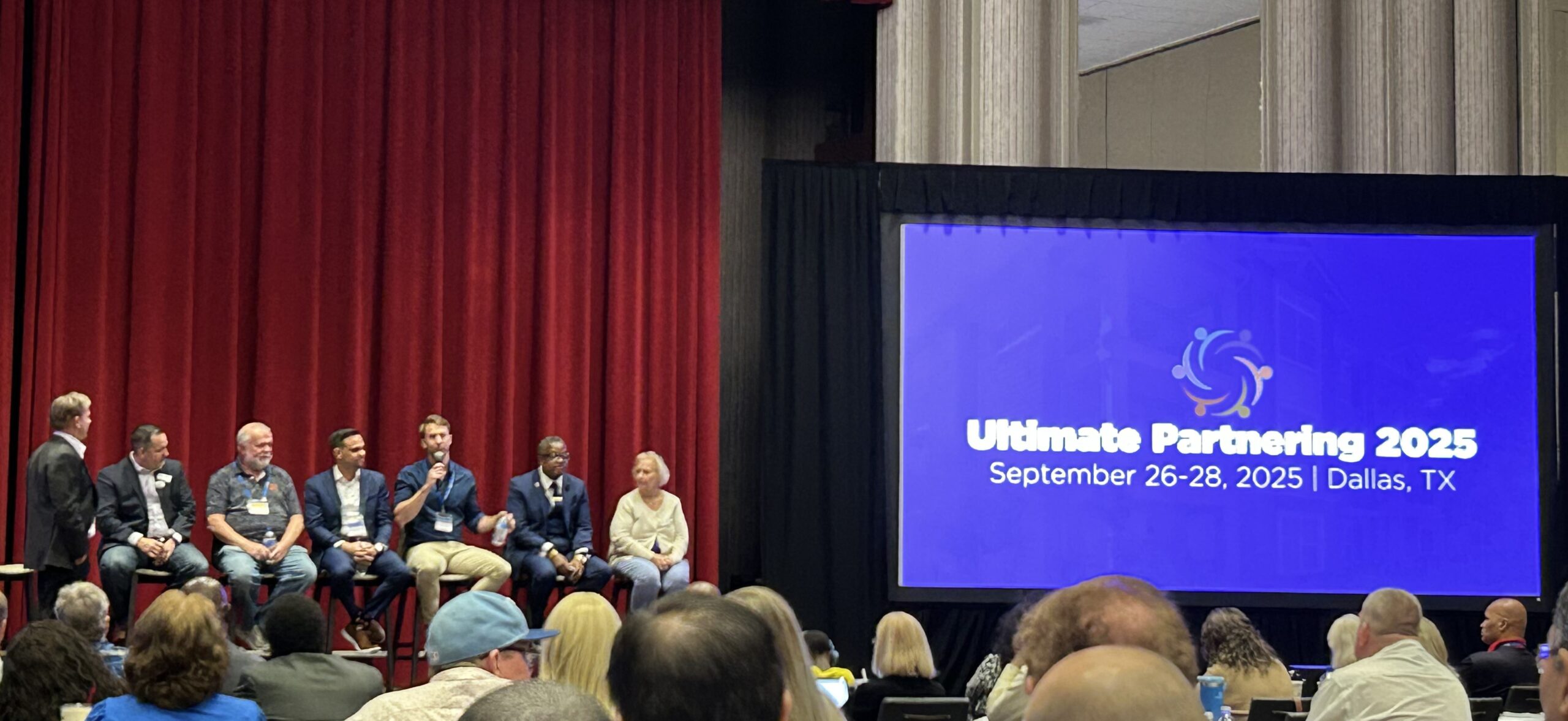

I had the pleasure of being on the “How to get started in Real Estate”…

21 George Newsletter April 2025

In early March, I attended the Best Ever Conference, a large real estate investment conference where people just getting started in real estate to institutional real estate investment firms gathered in Utah to network, learn and discuss the market. One topic of discussion dominated the conversation:

“Entering 2025, has the Fed achieved a “soft landing” for the economy or not?”

While this question drew all the attention, I found it funny that no one really defined “soft landing.” Many people shout about “interest rates” and “inflation” (buzz words), but they ignore one important piece–the actual economy!! I don’t know that there is an exact definition for “soft landing,” but in today’s economic climate as I understand it, I would say that a decrease in inflation to make for a more comfortable cost of living for low and middle-income earners, while maintaining a relatively strong labor market defines a “soft landing.”

Many argued that the Fed did achieve a “soft landing,” but the majority agreed that the “plane hasn’t landed.” The jury’s still out. In the month and a half since the conference, I would say that this theory has proven to be true.

Another argument claimed that since the Fed decreased rates, we have or will achieve a “soft landing.” However, this completely ignores increased costs of living and the overall health of the economy. It is a common misconception that if interest rates go down it is “good,” and if they go up it is “bad;” but this way of thinking only sucks us into a “spreadsheet vacuum,” a phrase I use when we only care about what our underwriting template (usually a spreadsheet) tells us: “If interest rates go down, my returns look better and I can pay more for a property!” This thinking made many investors fall into the trap of the post-covid high-leverage floating-rate debt.

The only real reason the Fed would significantly drop rates is if there is broader economic pain–a “hard landing.” They might modestly drop rates if they hit their inflation targets, but there is no reason to significantly drop rates if the economy continues to perform. The Fed uses interest rates as a lever to slow down an inflationary economy or spur growth in a down-economy, so there would likely need to be some pain in the economy before they make any significant rate cuts.

In other words, be careful what you wish for. If rates drop significantly, you may be able to decrease your interest rate, but you may also increase your vacancy rate and collection loss as well…

I’m not saying economic pain is coming (your guess is as good as mine), but rather, I’m highlighting the importance of a holistic approach rather than fixating on inflation and interest rate metrics. Don’t rely on interest rates decreasing to make your deal make sense, and don’t buy a property just because “inflation is good for hard assets.”

Instead, gain intimate knowledge of the markets you plan to invest in, to find truly undervalued opportunities, and put a great team in place to manage the heck out of your properties!