In early March, I attended the Best Ever Conference, a large real estate investment conference…

21 George Newsletter November 2025

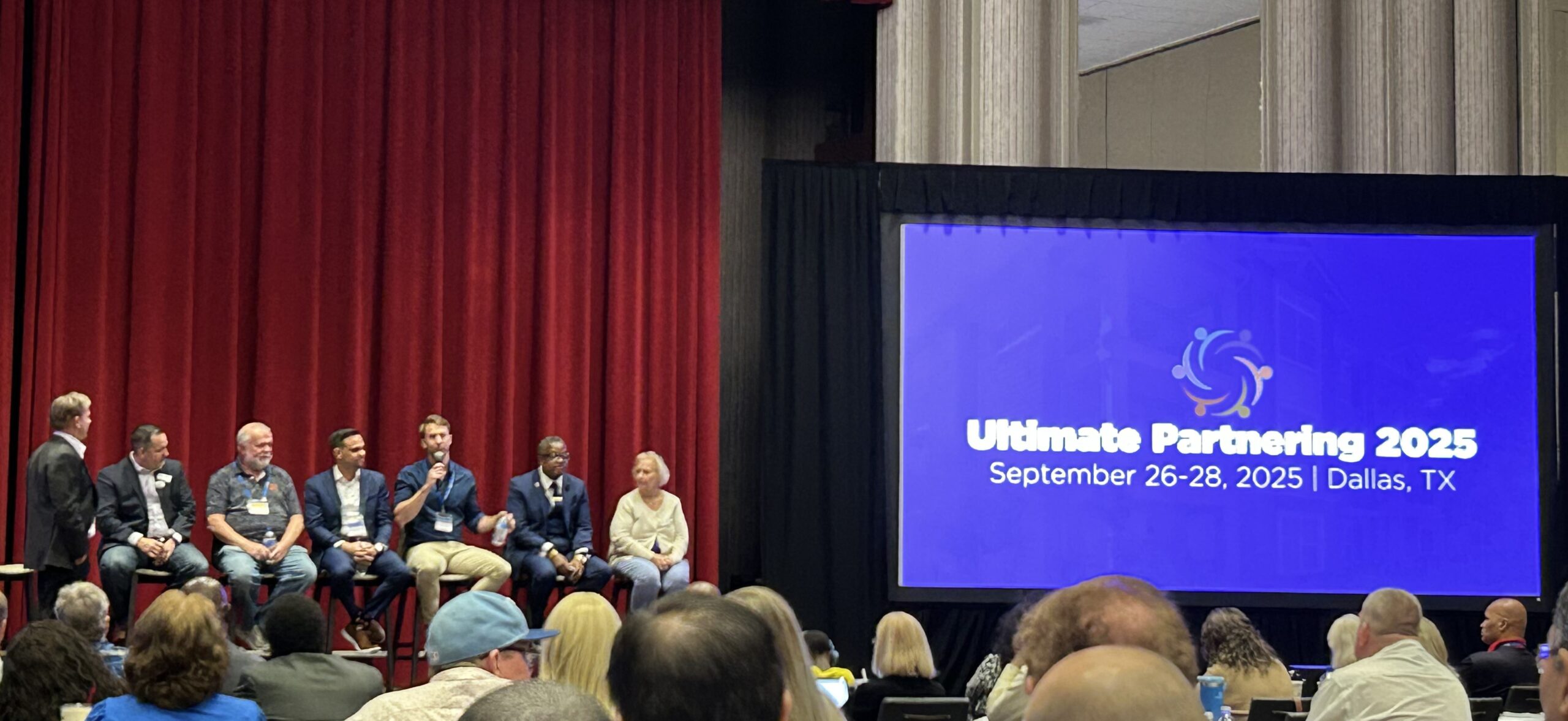

I had the pleasure of being on the “How to get started in Real Estate” panel at RE Mentors Ultimate Partnering event in Dallas last month. With nearly 1,000 people in attendance, the event draws people from all over the country and ranges from people just getting started in real estate, to investors with thousands of multifamily units.

So, how did I get started in real estate?

- I joined a multifamily real estate education program: I started my real estate investing journey pretty much right out of college. For someone with absolutely no real estate experience, or professional experience for that matter, I was lucky to be guided into a multifamily investing coaching program. I attended a few of the program’s live events, and it piqued my interest so I signed up for the “Coaching Program,” allowing me to learn from a coach in weekly meetings.

- I built my network: As an introvert, this was the hardest part. I built relationships with brokers and management companies so I could analyze deals and have someone tour properties with me. And how to find investors? As a recent college graduate, my “network” could barely afford to pay off their weekend bar tabs, never mind invest in my real estate deals. So, I stepped out of my comfort zone and I attended networking events to build a more professional network. (But that’s not to say you can’t build great connections at the bar!)

- I pursued deals that made sense to me: Most of what you see on social media or hear from speakers is “Go big!,” “The more units the better!,” “buying a 200-unit property is just as easy as buying a 20-unit property!” I’ll be the first to tell you that buying a 20-unit is much easier. With no real estate experience, no money, and no network, how the hell was I supposed to buy a 200-unit property in Texas, or Georgia, or XYZ hot market at the time? Instead, I started analyzing smaller multifamily properties in my “backyard” (New England) because that’s what made sense to me and what made me comfortable.

- I closed on a deal: Through the broker relationships I built, I identified a 6-unit property that met the return metrics I was coached to look for. Although it was only 6-units, I still had to raise the equity for the deal. I coerced a family member and family friend into investing with me (thankfully the deal went well!). Acquiring this property helped me get out from behind the spreadsheet and put everything I had been studying into action. While the coaching program I was a part of laid a great foundation, there is no better way to learn something than by doing it. And I learned pretty quickly that there is a lot more that goes into acquiring and managing real estate than what you see on your underwriting template.

- I implemented systems: Although everything didn’t go perfect on my first deal, or second, or third… I soon realized I was doing more than just investing in real estate; I was building a business. I took a step back from just looking at “deals,” and started building more of a comprehensive strategy with a more focused approach. I implemented systems to grow responsibly and better position our acquisitions to be successful investments.

- I formed great partnerships: Along with implementing better systems, I built strategic partnerships through relationships formed while continuing to grow my network. While the relationships that turned into partnerships felt organic, they were also strategic, defined, and with shared values. Be careful of the “oh, you like that deal? Me too! Let’s partner!” partnerships. I owe a lot of my success to my great partners.

While I’m sure there were a lot more steps along the way, and certainly many twists and turns, these are some of the biggest steps I took to create a multifamily portfolio, and to grow my business.