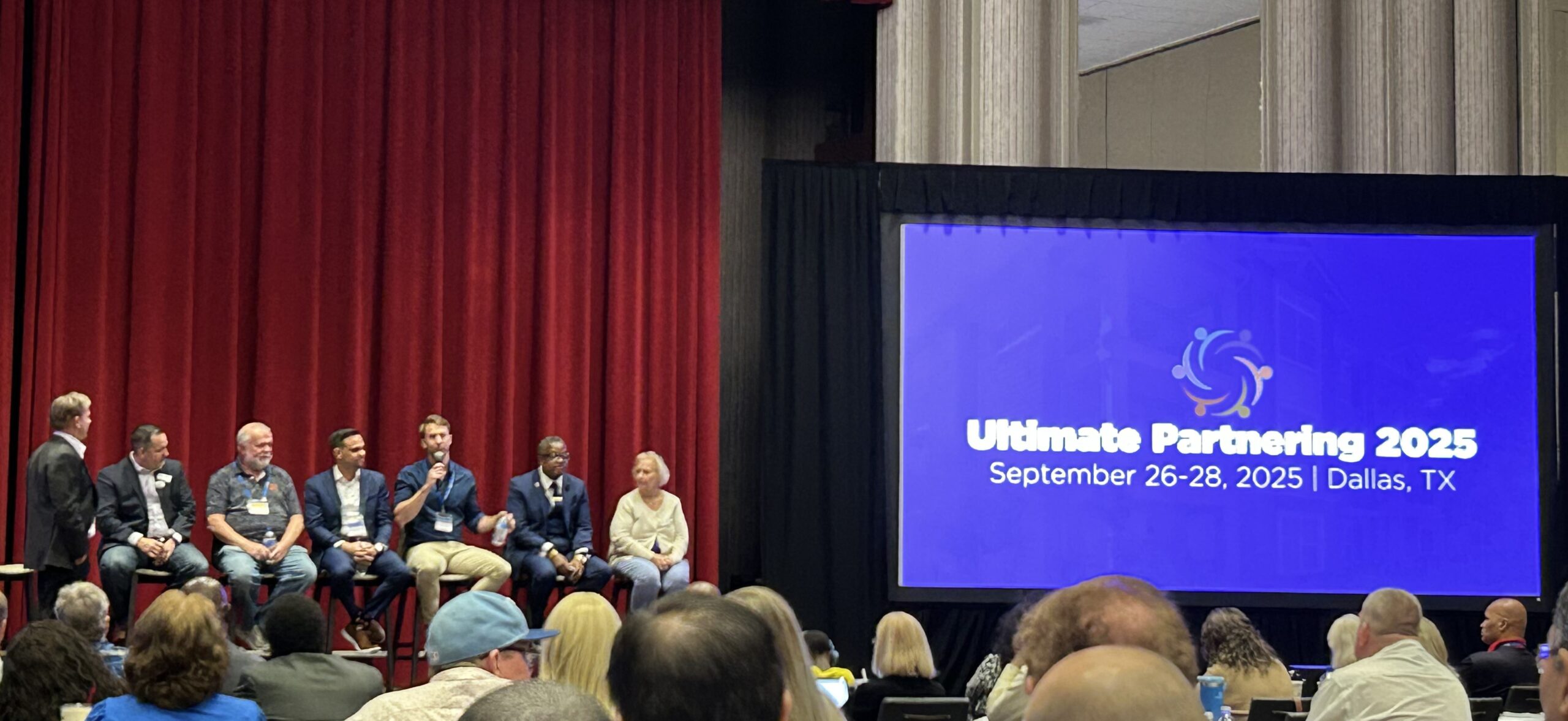

I had the pleasure of being on the “How to get started in Real Estate”…

Benefits to Investing in Tangible Assets

While the outcome of broader financial investments rely solely on market appreciation (or lack thereof) influenced by uncontrollable global economic trends, investing in tangible assets (in this case multi family real estate) gives operators much more control over the outcome of an investment. Advantages to investing in tangible assets include, the ability to add value directly to the asset, the ability to acquire under valued assets, and the ability to leverage the investment through financing.

Value Add Multi Family real estate investments offer operators the ability to add value directly to the asset through both physical and operational improvements. A simple cost/value analysis can be done for physical improvements. If the cost of the improvements is less than the value it creates, value is immediately added to the asset.

Value can be added through operational improvements as well. Proper management will maximize income by minimizing vacancies and non-payments while achieving market rent from qualified tenants. The ability to identify ways to decrease expenses also helps increase the assets Net Operating Income, which, in turn, increases the value of the asset.

Acquiring Under Valued Assets Often overlooked, the ability to acquire assets under market value is a major advantage to investing in multi family real estate. While in other investment platforms the barrier of entry is determined by the market, multi family purchase prices are negotiable. By identifying motivated sellers, multi family buyers can negotiate favorable acquisition prices. Through proper market analysis and asset due diligence buyers are able to assign their own value to an asset. Acquiring under valued assets adds value to the investment immediately upon acquisition.

Leverage While most investments are all cash investments, multi family investments can be leveraged with debt financing. While interest rates remain low, the ability to borrow against an asset at a rate lower than the asset appreciates adds tremendous value to the investment. In some cases, lenders will even finance capital improvements contributing directly to the appreciation of the asset.

In recent months, 21 George Investors has witnessed the advantages of investing in tangible assets first hand…

Case 1 In 2014, 21 George Investors and partners purchased an underperforming 12-unit property for $37,500/unit from a tired landlord. Due to the appraisal price coming in well above the purchase price 21 George Investors and partners were able to obtain competitive financing that covered much of the physical improvements and professional management corrected the operational flaws both adding tremendous value to the asset.

Recently, a comparable property blocks away from the subject property went under contract for $100,000/unit… a very favorable value comparable! While the subject properties local market has appreciated since the acquisition, both the ability to purchase below market value and add value to the asset through physical and operational improvements has added significant value to this asset.

Case 2 This past April, 21 George Investors and partners purchase an off-market, underperforming 24-unit property for $50,000/unit. Again, the appraised price came in well above purchase price allowing for competitive financing. In relatively good condition, only minor physical improvements were needed while professional management was implemented to improve operations. After acquisition, an abutting property owner approached 21 George Investors and partners looking to sell his property. While we were not able to come to terms, the abutting property in similar condition, layout, and size to the subject property recently went under contract for $68,750/unit. Again, a very favorable value comparable!

These two case studies show the benefits of investing in tangible assets. While the outcome of broader financial investments rely solely on appreciation (if you’re lucky), tangible assets allow value to be added through physical and operational improvements, upon purchase by acquiring under valued assets, and by leveraging competitive financing… as well as market appreciation!