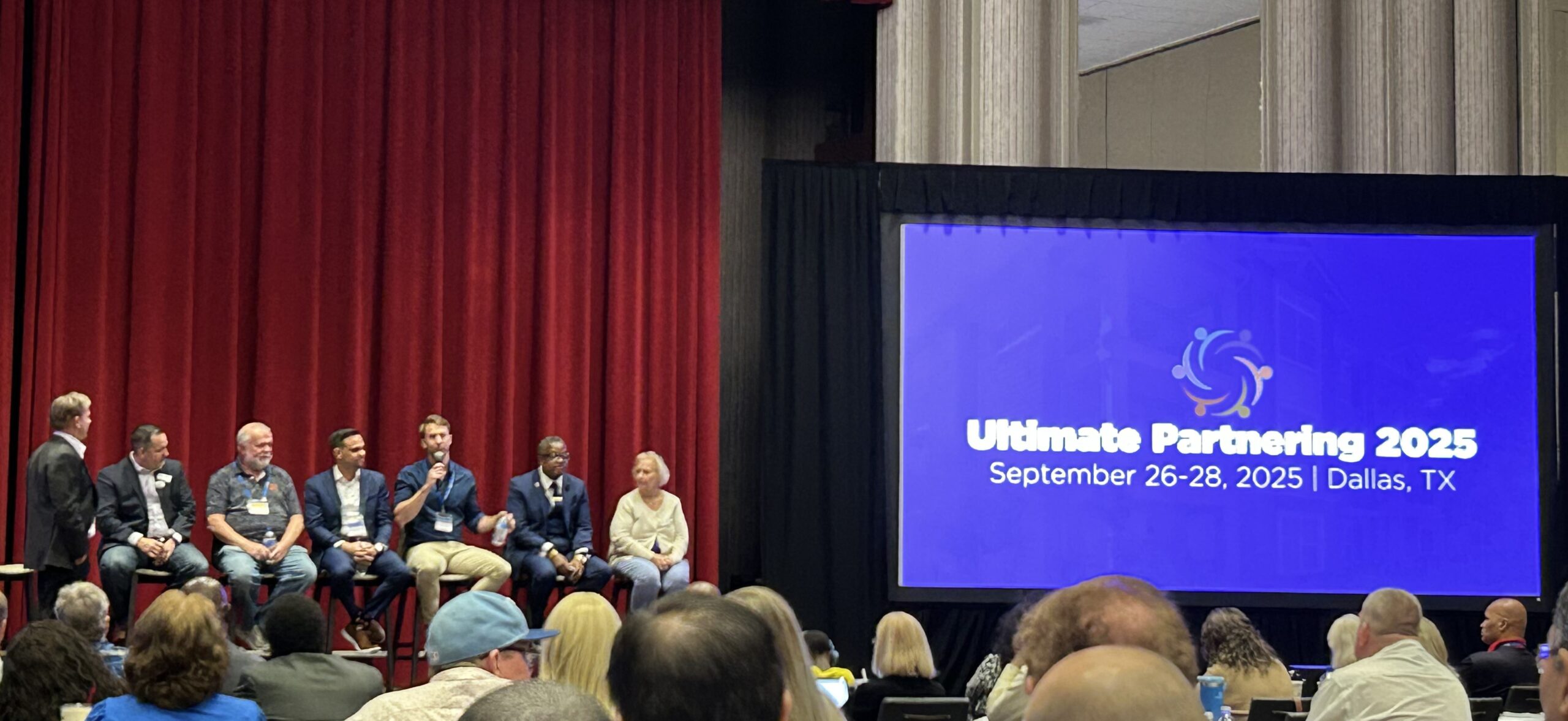

I had the pleasure of being on the “How to get started in Real Estate”…

21 George Newsletter July 2022

“All time is uncertain”

Acquisitions/Dispositions

We ended Q2 2022 by going “full cycle” and selling our 52-unit property in Chicago. We purchased this property in March of 2020 right as the pandemic was hitting. At the time, it was a major decision to proceed with this acquisition while the world was shutting down around us.

During the acquisition process, our lender dropped us due to the pandemic so we scrambled and purchased this property with a hard-money loan (and later refinanced into a construction loan). This property was a major reposition as well: we purchased it at 70% occupancy, renovated units, replaced the roof, replaced the boiler, did significant tuck pointing, improved the curb appeal, and brought it to 90%+ occupancy — all while facing the many challenges caused by the pandemic.

We are happy to announce that we exceeded our return projections on this deal and are extremely grateful for our partners involved in it!

After a successful exit it is easy to look back and say, “there was so much opportunity X years ago when we bought the property”, but if you really think back to the spring of 2020, you might remember investor confidence being a little different. By staying committed to our overall investment strategy and our asset plan for this specific property, we were able to make it a successful deal even during an “uncertain” time. That may be something to keep in mind as we navigate the current volatile interest rate environment.

I hope to have a video of this project to share soon.

We are currently actively seeking new opportunities in New Hampshire, Baltimore, and certain southeast and midwest markets. If you have any interest in learning more about these opportunities, please consider logging into our portal or schedule a call with me. The Portal will give you a first look at future opportunities as well.

We continue to focus on identifying and acquiring undervalued multifamily properties that we can effectively manage for an indefinite amount of time.

Events

We had a great time being Sponsors at the RE Mentor Sponsorship Event! There were varying degrees of real estate investment experience at this event, so it was a great opportunity to learn from more experienced investors, and help educate less experienced ones.

What is a “Sponsor”? In this case, a Sponsor is an individual, or company, who meets financial and investment experience qualifications required by lending institutions to get a loan for a multifamily property. A Sponsor is a vital member of any team, and will usually bring more to the table than just the ability to get a loan- including acquisition and asset management experience.

About 21 George Investors

21 George Investors is a privately held investment firm focused on income producing multi-family real estate opportunities with value add components in specific US emerging markets. By leveraging industry expertise we have implemented a proven proprietary system focused on market knowledge, asset analysis, and asset management allowing us to provide high yield passive cash flow and long-term capital appreciation investment opportunities.

Check out our website at 21GeorgeInvestors.com and follow us on LinkedIn.