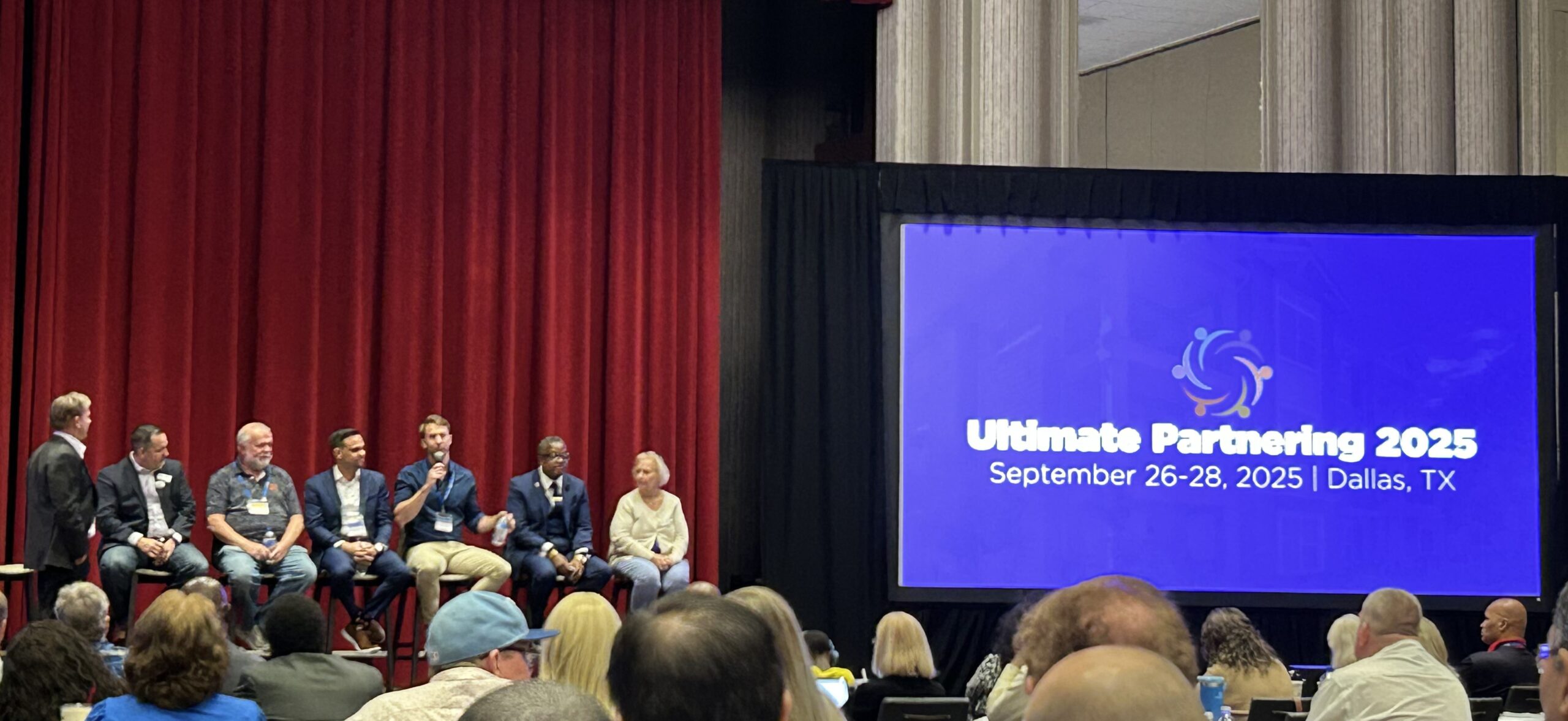

I had the pleasure of being on the “How to get started in Real Estate”…

21 George Investors Newsletter July 2021

“You must never confuse faith that you will prevail in the end, with the discipline to confront the most brutal facts of your current reality.”

Market Overview

Although the country is opening up, the question remains; how is the recovery going? And how is it effecting the rental market? I have come across many articles recently outlining occupancy, rent growth, and retention percentages on a national level; all of which point to a healthy, growing rental market. While these short-term figures are great to see as an apartment investor, as long-term investors, we like to take a step back and look at the market fundamentals.

Between the stimulus and near-zero interest rates, Inflation is the big buzz word among economist right now. Income producing hard assets are a great hedge against inflation, especially multifamily real estate. Tenants typically have longer lease’s in other asset classes such as office and retail locking tenants in for 3+ years with predetermined annual rent increases. In multifamily, we get to evaluate rents on an annual basis (12-month leases) and organically increase them at the rate of inflation or better, depending on the market. Also, the ability to leverage properties at today’s fixed rate for 5-10 years provides enormous value. While inflation will increase rental rates and property values, debt service payments will remain the same.

Supply and demand factors continue to drive strong occupancy, retention, and rent growth. There is already a severe shortage of affordable housing across the country, and rising material costs are making it increasingly more difficult to construct affordable housing. This will continue to drive rental demand for B and C assets.

Deal Sourcing

I recently took a trip to North Carolina (one of our target markets) to meet with brokers and tour properties. Visiting target markets is a great way to source deals. No amount of phone time can compare to sitting down for a coffee or beer with a local broker. Getting on a flight to meet brokers in person gives you a level of credibility that sets you about from the hundreds of other investors calling the same brokers on a daily basis.

We also continue to work with our boots on the ground partners in various markets to source deals. We do not have anything under contract at the moment, but we expect our next deal to be coming soon.

Events

About a month ago, we had the pleasure of appearing on an episode of the Multifamily Deal Lab Podcast with Dave Lindahl. Dave Lindahl is the founder of RE Mentor, a multifamily investment educational program and community we owe a lot of our success to. It was a pleasure being able to sit down with Dave to discuss one of our most recent acquisitions and the progress we have made over the year’s

We also hosted a Zoom networking event highlighted by a great presentation by applied demographer, Scott Stafford. Scott has used his demographics background to develop a software that helps identify emerging markets across the country. He has even taken it a step further to identify emerging neighborhoods within a given market. This is extremely valuable information as a multifamily investor as it helps us identify appreciating markets.