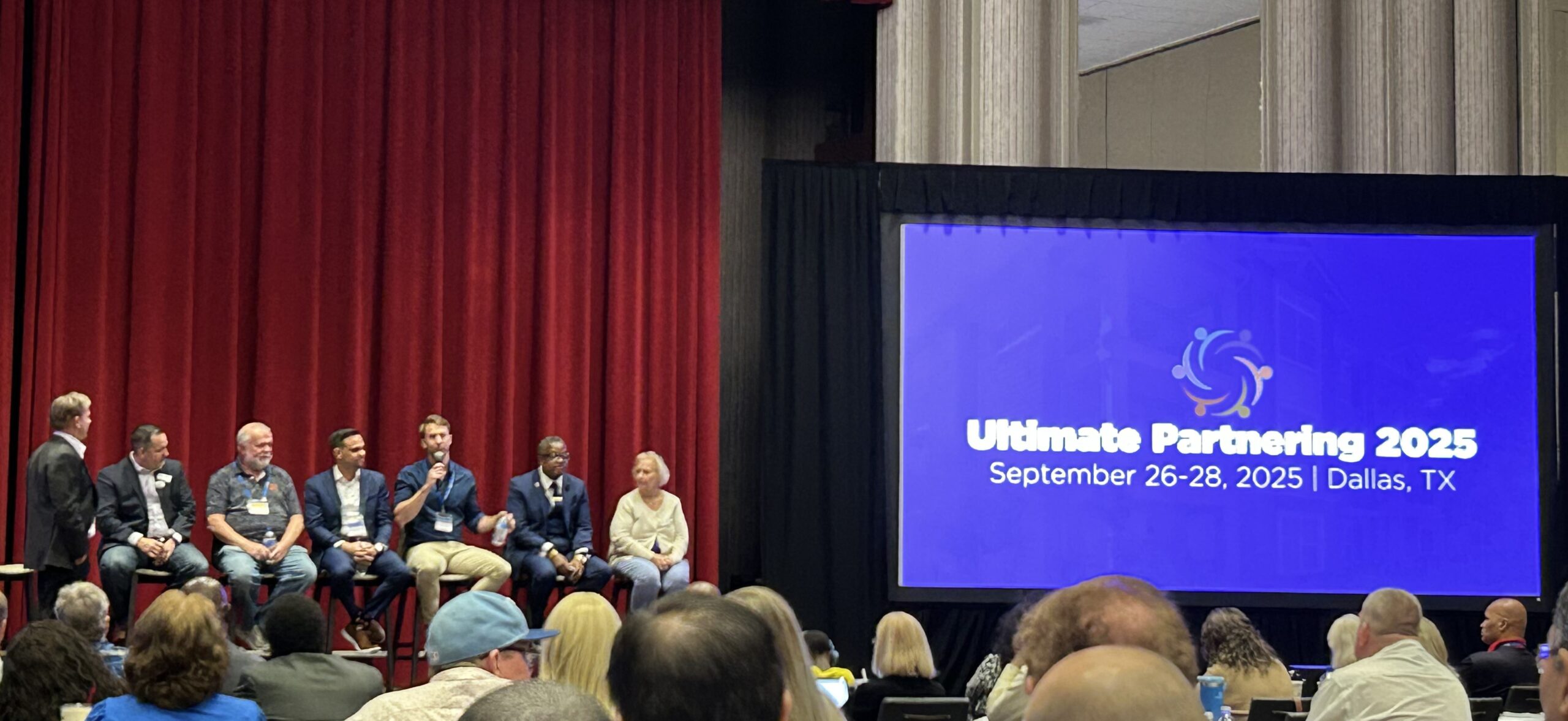

I had the pleasure of being on the “How to get started in Real Estate”…

21 George Newsletter October 2020

“The best time to plant a tree was 20 years ago. The second best time is now.”

As we enter the final quarter of a year that forced many people to press the pause button, we are happy to announce that we have a lot to update you on. We entered the year planning for continued growth, and while circumstances out of our control may have slowed that growth, these circumstances only reinforced what our goals really are. That is, not to become a cyclical investment firm riding the ups and downs of the market, but rather an operating company that can identify, acquire, and manage undervalued real estate to provide strong risk-adjusted returns at any point in the market cycle.

Acquisitions

Back in March we closed on a 52-unit property in Chicago, IL. This was our first acquisition in the mid-west. We purchased the property at about 70% physical occupancy and an even lower economic occupancy. Over the past 6-months we have performed significant rehab to the property while increasing occupancy and collections. We are still working through the reposition but, so far, we are on time and on budget. Follow us on LinkedIn to see some of the work being done on this property.

We developed a strong relationship with multifamily operators in the Chicagoland area that we partnered with on this deal. They have played an integral part in the acquisition and management of this asset. This is a relationship we hope to grow.

TEASER ALERT… We have another 64-unit property under contract in the Chicagoland area. The properties occupancy and collections have stayed near pre-coronavirus levels throughout the due diligence period. There will be more to come on this opportunity…

We have submitted offers on several other deals so far this year and continue to look for opportunities in New England, several southeast states, and Chicagoland.

Fill out this form if you are interested in learning more about our investment opportunities.

Finance

Lenders have become more stringent since the shutdowns in March, so we decided to refinance 6 properties! In reality, we started the refinance process before the shutdowns but did not close on any of them until the end of April, and we recently closed the last two in September. Fear of collections dropping was certainly a concern, but lenders pulling back was the biggest hurdle we have had to overcome since the pandemic (We consider ourselves very lucky and grateful both professionally and personally!).

When reviewing our portfolio earlier this year, we had to decide what we wanted to do with several properties we owned for 5+ years. We discussed holding them to pay down existing debt, or selling them to recapitalize, but we ultimately decided to refinance them. By refinancing these assets, we were able to;

- pull capital out giving us and investors capital to deploy into new opportunities,

- take advantage of the current low interest rate climate to decrease our annual debt service and increase cash flow even while increasing our leverage,

- build up a healthy reserve account for each asset and,

- maintain a sub-70% debt to equity ratio on these assets

While the process was tedious at times, the ability to leverage cash flowing real estate with low-interest debt financing continues to make multi-family an attractive asset class.

Management

Collections dropping and vacancy rates spiking have grabbed the headlines since the pandemic induced shutdowns back in March. Many analysts suggested April, then May, then August when the additional unemployment ran out as months collections would really drop but, so far, our portfolio has remained at 95%+ economic occupancy throughout 2020 (not including properties in the lease-up phase). And we are happy to see that rental activity is still strong at properties we are leasing up.

We are not out of the weeds yet so we continue to closely monitor collections on a monthly basis. But above all, we are focused on the management issues we can directly control. That is, keeping our communities clean and safe, addressing work orders, making property improvements, stringent tenant screening, communicating effectively with tenants, overall managing the property at a high level. Tenants will pay rent at a property they enjoy living at. Properties with disinterested or ineffective managers get hurt the most during a down-cycle. Proper asset management is more important now than ever, but for good managers, really nothing has changed.

We are also keeping healthy reserves on our properties to protect against any collection issues in the future.

Moving Forward

2020 has been a year of uncertainty and it is not over yet. But, to quote Warren Buffett, “people talk about this being an uncertain time. You know, really all time is uncertain.” While it is ever important to monitor financial, economic, and demographic trends, rather than trying to predict the market, we continue to be focused on identifying and acquiring undervalued real estate that we can effectively manage for an indefinite period of time to provide strong risk-adjusted returns to our investors.