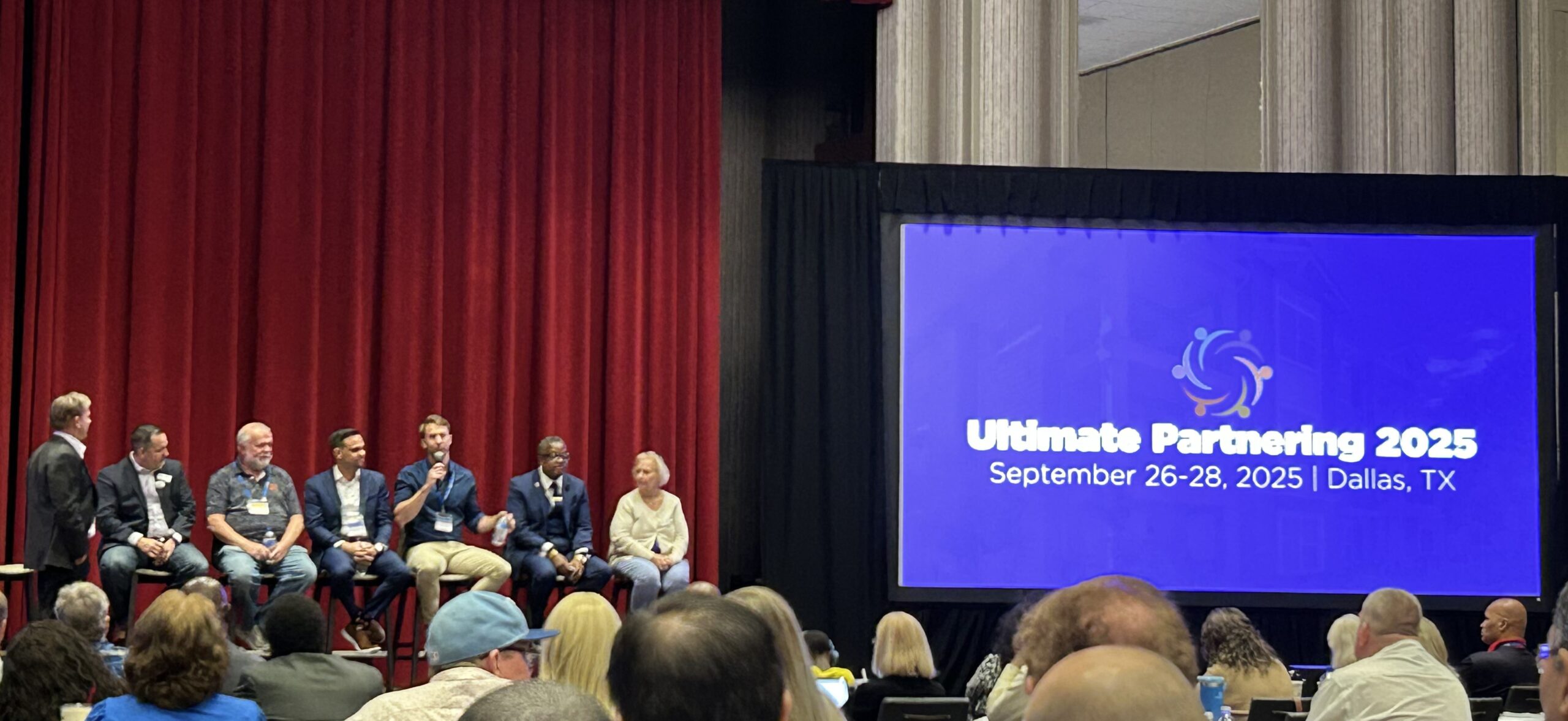

I had the pleasure of being on the “How to get started in Real Estate”…

March Madness in Financial Markets

This time of year is typically known as March Madness due to the competitiveness and upsets that take place in the NCAA Basketball tournament. While the March Madness tournament has been cancelled for the first time since its inception in 1939, with the Coronavirus pandemic spreading throughout the country, and the world, forcing businesses and much of the hospitality industry to shut down and forcing many municipalities to “shelter in place”, this March has truly been Madness.

The current health and economic uncertainty has had a major impact on the financial markets wiping out a majority of the gains realized over the past several years in just one week. While multifamily real estate is not as volatile as the stock market it will certainly still be affected by these current events. Many service industry workers are now filing for unemployment as the hospitality, entertainment, travel, and other industries, scale back employment due to the recent shut downs. Service industry workers are one of the main demographics driving the rental market.

While the market has been a fun ride the last several years, we invest in multifamily real estate to avoid “the market”. When the economy is strong the market can sometimes hide ill-advised investments, but it is in times of economic uncertainty that it is good to revisit basic investment principals that will perform well in an up-cycle and mitigate risk in a down-cycle.

Here are some of 21 George’s multifamily investment principals:

Invest in a Strong Local Economy– we identify markets with diverse local economies driven by several recession resistant industries. While population and job growth are both metrics we look at when analyzing a market, we first need to make sure the local economy is diverse. Population growth could be occurring in a market but if the growth is driven by just one industry then that market will be the first to soften if that industry declines. The market needs a foundation before you can build on it.

Invest in Properties We Can Manage– if we do not think we can effectively manage a property for 5-10 years then it does not fit out investment criteria. We do not purchase properties just to try to catch the market on an upswing and then sell. We purchase properties we can manage regardless of what the market is doing. We do this by building strong relationships with professional third-party management companies, partnering with boot on the ground asset managers, and building a network of contractors and real estate professionals in a market.

Invest in Undervalued Properties- we do not overpay for properties. We identify properties that are being mismanaged that we can acquire at a discounted price. Purchasing these properties gives us the ability to add value directly to the asset through physical improvements and operational efficiencies. So, no matter what the market is doing, we are adding value directly to our property. After adding value to the property, it is important to maintain a healthy debt to equity ratio and a reserve on the property. Each asset should be looked at as a separate operating company and companies with too much debt and/or too little reserves do not fare well when the market turns.

Identifying Value-Add Opportunities not tied to Market Metrics: the most common value-add among multi-family investors is, “we’re going to raise rents”. While that is most certainly the easiest way to increase the value of a multi-family property, you can only increase rents as much as the rental market allows. When the rental market softens, increasing rents is not as easy as it sounds. The ability to reduce expenses, however, is not tied to any market metrics.

One way we have been able to do this is by identifying energy saving solutions to reduce utility costs. Specifically focusing on Solar and Wood pellet technologies we are able to reduce carbon emissions and the use of fossil fuels along with our utility expense. This “doing well by doing good” is consistent with our mission to respond to New Urbanist principles in our purchases of multi-family real estate.

While these may seem like basic multifamily investment principals, it is sometimes easy to lose sight of these principals when market appreciation is there to correct your mistakes. But when the market is no longer there to correct your mistakes is the best time to revisit these principals and mitigate the madness.

NEXT: Finding Value in Energy Efficiency and Climate Change Economics

In the past year we have brought a property on-line in Vermont that is serving as a model for an energy savings approach we are exploring nationally. Vermont Solar and Energy efficiency policies incentivize energy efficiency and a desire to reduce carbon emissions that contribute to global warming. We believe this is an inevitability in the future commercial real estate market. This will be subject to an upcoming case study in a future newsletter but is mentioned here as our continuing attempts to seek creative ways to find value for our investors in emerging markets.

COMING SOON: 21 George Capital LLC

We are creating our own capital equity funding and debt resource to assist investors close on deals quicker and cheaply to take advantage of the more competitive multi-family market we are seeing throughout the United States. In competitive markets we feel that we are still finding value opportunities in multi-family properties of under 100 units but often when front-end capital costs are the main driver of the “value add” we need to move too quickly to strike when the opportunity arises. We are partnering with others to create a Fund that will help us find and close on deals that we find from our partners in Alabama, Illinois, Florida, North Carolina and New England.