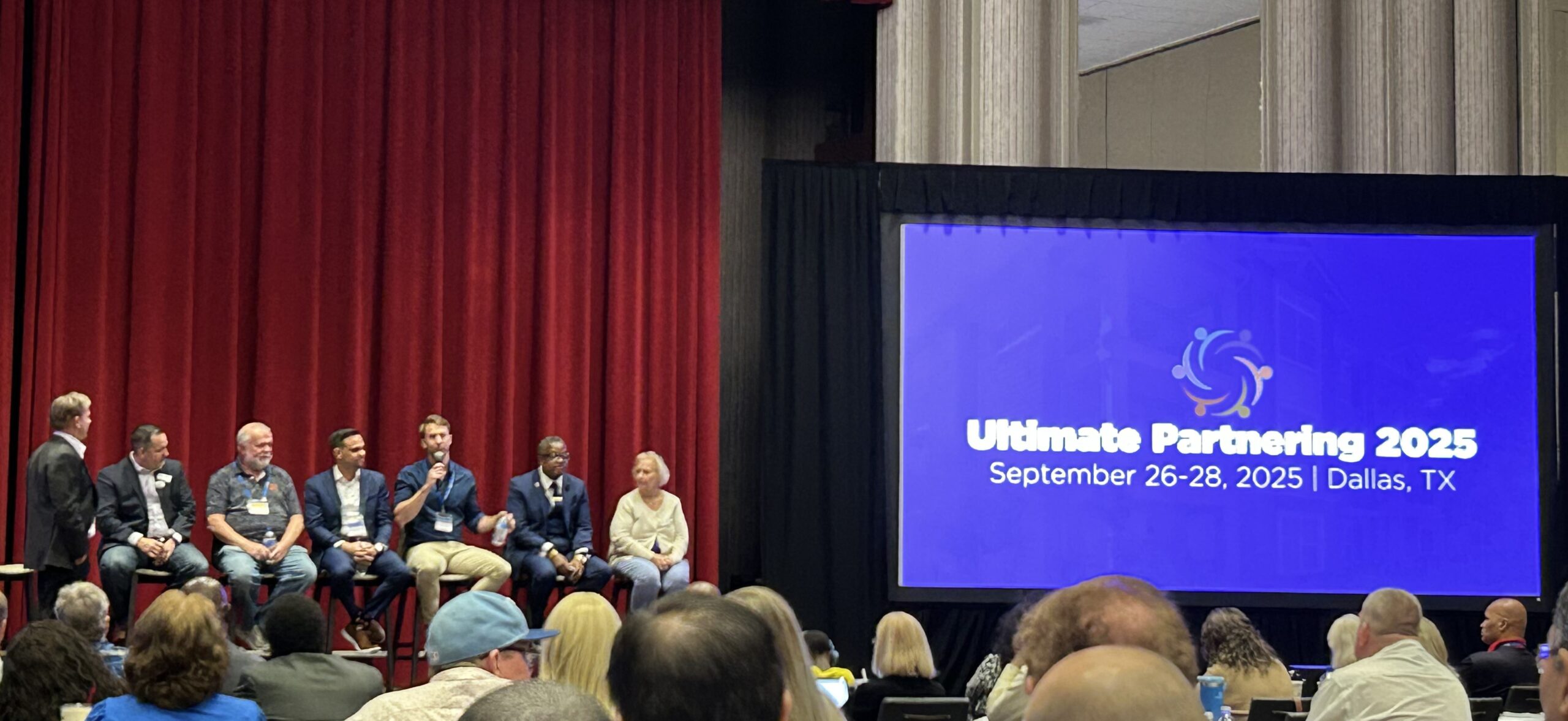

I had the pleasure of being on the “How to get started in Real Estate”…

Market Cycle Stage

It has been a while since our last newsletter but we have been staying busy over the past several months focusing on the asset management of our existing holdings and strategizing the continual growth of our portfolio as the investment real estate market tightens. 21 George Investors purchased its first multifamily property in 2013 and began investing heavily into multifamily in 2014. Since that time, we have had the opportunity to see how a maturing market affects the acquisition process and learned the importance of asset management throughout the cycle.

Like most investment vehicles, real estate is cyclical. Various economic and demographic indicators influence the cycle but it is often hard to identify which stage of the cycle we are currently in. In 2008/2009 after the economic recession it was pretty clear we were at the bottom of the cycle, but after a decade of this unprecedent growth it is harder to determine the cycle stage as cap rates compress but demographic and economic indicators still suggest stability in multifamily assets.

As multifamily operators we are always evaluating where we are in the cycle. One way to do this is to attend local and national real estate conferences. Over the last several months we have attended these conferences to network and listen to other multifamily operators. By doing this we are not only able to hear their opinions on where we are in the cycle but also the different investment strategies operators are utilizing in the current investment environment. While some operators are pursuing acquisitions more aggressively than others, pretty much all agree that we are close to the top of the cycle and the acquisition landscape has become extremely competitive. The more aggressive operators are maintaining business as usual by continuing to invest heavily in multifamily and relying on asset management and the strong demographic trends that continue to point towards the rental market to drive returns. Some of the more conservative operators are slowing down their acquisitions and selling off some of their portfolio. Others are turning towards alternative real estate assets such as retail, office, or flex space in search of higher yields.

When we starting investing heavily into multifamily in 2014 our acquisition pipeline seemed endless finding one value add opportunity after the next, but over the last year or so it has been increasingly difficult to find attractive value add multifamily opportunities. Because of this it has become clear to us as well that we are approaching the top of the multifamily cycle at a national level. But that is not to say there are not any attractive multifamily opportunities out there. Real Estate is historically viewed as a stable, conservative investment that is not as volatile as the stock market. After being spoiled the last several years by the appreciation gained strictly through the momentum of the market cycle it is time for investors to think of multifamily as a conservative investment again with cash flow and tax benefits. There are still plenty of multifamily investment opportunities out there with attractive risk adjusted returns for investors who can adjust their expectations after the latest run.

While some investors are stuck trying to predict the next economic correction we are focusing on the continued job growth and strong demographic trends that, with delayed home-buying for Millennials and Boomers downsizing, still favor the rental market for years to come. Many Millennials, Boomers, and working-class individuals are also fleeing primary cities with high costs of living for smaller robust areas where their dollar goes further. By following these trends, we are able to identify growing markets that still have strong multifamily investment opportunities left in them. So, while we acknowledge we are near the top of the cycle on a national level, we are slightly adjusting our return expectations and following the demographic trends to continue to seek multifamily opportunities with strong risk adjusted returns.